I’m bullish on crypto and blockchain. I am also bullish on Bitcoin. Well, I should say the idea of Bitcoin. Bitcoin is the poster boy of all things crypto right now, and as the next store of wealth. As we all know, bankers, governments, and Wall Street don’t like Bitcoin, and that would be putting it mildly. Who likes Bitcoin? The people do.

If BTC holders keep a unified front, there would be a good chance of BTC mooning in the near future. The problem is, there are thousands of cryptocurrencies. Just recently, the NIST couldn’t make up their mind as to whether Bitcoin or Bitcoin Cash was the original blockchain.

Now consider the sociopolitical climate for Bitcoin and what people are being fed recently by the media:

- Steve Wozniak sold all of his BTC – https://www.cnbc.com/2018/02/02/apple-co-founder-steve-wozniak-on-selling-bitcoin.html

- The founder of Litecoin sold all of his holdings – https://cointelegraph.com/news/charlie-lee-bullish-on-bitcoin-and-litecoin-long-term-short-term-impossible-to-predict

- Musings from Wall Street – https://cointelegraph.com/news/wolf-of-wall-street-says-bitcoin-could-hit-50k-before-crashing

- Novagrats delays plans for $500M crypto hedge fund – https://cryptovest.com/news/novogratz-puts-crypto-hedge-fund-plan-on-hold/

- Banks have banned buying crypto with credit cards – http://www.businessinsider.com/jp-morgan-bank-of-america-citigroup-ban-bitcoin-credit-card-buying-2018-2?r=UK&IR=T

- The IRS is cracking down on exchanges, and Coinbase will be issuing 1099’s – https://coinnews.zd.fr/getting-served-coinbase-stunning-some-users-with-tax-forms/

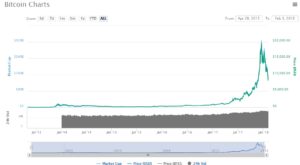

One projection shows that Bitcoin is still on the uptrend, and the recent drop was just a correction.

However, I don’t want to be stuck looking at prices through a paper tube and missing the bigger picture.

Bitcoin has been compared to a bubble in the last decade countless times, and in hindsight it is laughed at by all the hodlers. The landscape of BTC holders today has shifted to include mainstream early adopters. Bitcoin exposure and threat has reached a point where governments, banks, and Wall Street have stepped in. Even if someone takes the position of past performance being an indicator of future performance, one has to acknowledge that there are larger macro forces at play now. That is why further consideration should be made compared to the countless BTC corrections in the last decade.

- Let’s take a look at this article from 2013. This is an example that BTC holders would look back and laugh at. Look at the picture of the overlay of BTC prices: http://fixwillpower.com/blog/bitcoin-bubble-crash/

- Now the market is a fractal remember? Let’s zoom out, and we see something familiar:

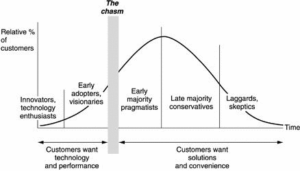

- That signature double peak looks familiar. Correlations can be drawn to this well-known diagram if BTC holders lose confidence.

- We are in a very speculative market where people are investing in ICOs without a working product. However, even viable high quality ICOs are considered overpriced by many, and yet people are buying. As an analogy, start ups have bypassed the VC model, and are jumping to IPOs. This can not sustain itself, and all this money will flow back into the top cryptoassets at some point. Additionally, the technology has not caught up to warrant the prices for the most part. Therefore, additional correlations can be drawn to another well-known diagram as to a potential chasm before widespread adoption of technology.

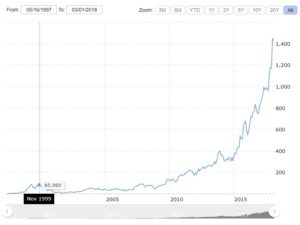

- During this chasm, we are talking about a massive “discount” of price. Let’s revisit the Amazon stock and the dot com bust.

- AMZ was $85 in November of 1999, and prices didn’t recover to $85 until September of 2007, that is EIGHT YEARS later. Now, everything in crypto moves much faster since we are in the internet age. However, the speed of tech adoption is not the speed of price movement. So let’s say BTC drops to $5K, and that’s the absolute bottom (which very well might not be the case). How long will we stay there, weeks? Months? Years? Plus I not fully convinced that BTC will be king in the coming decade even though currently it is positioned to be. Depending on how much you have invested in crypto, waiting a long time may not matter to you. Especially if you are holding for the idea. Maybe you don’t care much where the price goes. Myself as a trader, I have a lot of money in the market, and a significant loss over an extended bear market is something I am going to do my best to avoid.

I am being very cautious in the upcoming days/weeks. Especially with potentially more regulation coming very soon (https://www.coindesk.com/sec-cftc-chiefs-set-senate-crypto-hearing-next-week/). If the governments really want to crack down on crypto, they can. After all, even alcohol was banned at one point. Actually, crypto traders have been jailed before as well (https://www.coindesk.com/detroit-bitcoin-trader-gets-jail-time-for-unlicensed-money-business/). I will be paying close attention to this BTC bounce as it potentially hits $10K/$11.2K/$11.6K. At that time, the alts should have recovered pretty well and it could be time to take chips off the table. Time will tell what the market does. I hope I’m wrong. With that said, a drop to $5K is another 20-30%, which isn’t that out of the ordinary all things considered. I would be very surprised if it doesn’t hold at that level. So there’s the case to be made to hodl through.